Key Numbers as You Plan for 2024

Are you familiar with how our federal tax code originated?

In 1909, progressives in Congress attached a provision for an income tax to a tariff bill. Hoping to kill the idea for good, conservatives proposed enacting such a tax as they believed 75% of states would never ratify a constitutional amendment, according to the National Archives.

Much to their surprise, the 16th Amendment was ratified in 1913, establishing Congress’s right to impose a federal income tax. Initially, fewer than 1% of the population paid income taxes. The rate was only 1% of net income due to generous exemptions and deductions.

Clearly, the tax code has changed dramatically over the years, and it will continue to change.

Diving into the Details

The Internal Revenue Service announced last year the annual inflation adjustments for more than 60 tax provisions (63 to be exact) for the tax year 2024, including the tax rate schedules. As incorporated into law, the IRS adjusts various categories to account for inflation.

It’s not a perfect measure, but the adjustments help mitigate the impact of inflation on income. Without indexing, a cost-of-living raise, for example, could automatically push you into a higher tax bracket or reduce the value of your standard deduction.

Annual inflation adjustments, however, do not cover all tax provisions.

We won’t cover each of the 63 changes. We will touch on the high points. If you have questions, please reach out to us. As always, if you have specific tax questions, feel free to check with your tax advisor.

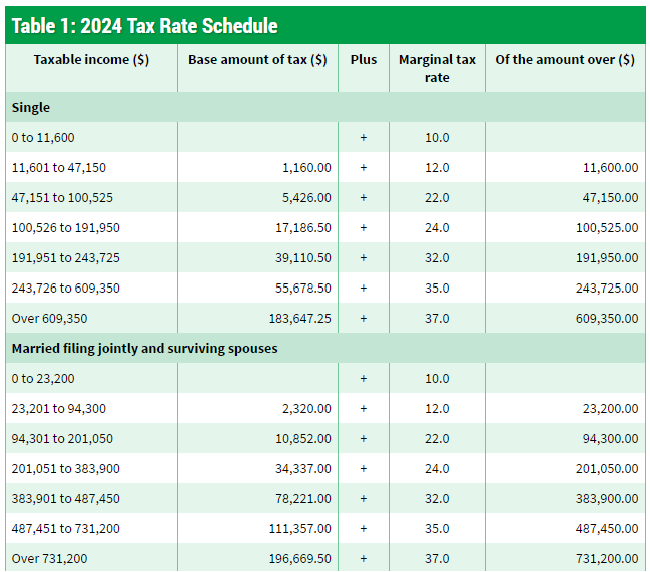

1. Tax brackets and tax rates have changed. Table 1 highlights the seven separate tax brackets for 2024 for single, married, head-of-household and married filing separately.

For example, if you are married, filing a joint return, and your taxable income is $50,000, you would pay 10% to the federal government on income up to $23,200. You would pay 12% on the remainder of your income up to $50,000.

2. The standard deduction in tax year 2024 rises to $29,200 from $27,700 for those who are married and filing jointly. The standard deduction for single filers and married and filing separately rises to $14,600 from $13,850. For head of household, the standard deduction rises to $21,900 from $20,800.

If you are 65 or older and single or head of household, you may take an additional deduction of $1,950. If married and filing jointly or separately, you may take an additional $1,550.

Changes on the Horizon

The Tax Cuts and Jobs Act (TCJA) of 2017 significantly increased the standard deduction, simplifying the filing process, as it eliminated the need for many taxpayers to itemize. But it also scrapped the personal exemption.

Unless extended, please be aware that many provisions of the TCJA will expire at the end of 2025.

Among the expected changes:

- Individual income tax rates will revert to their 2017 levels.

- The standard deduction will be cut roughly in half, the personal exemption will return, and the child tax credit will be reduced.

- The estate tax exemption will be reduced.

- The special 20% tax deduction for pass-through businesses will disappear.

- The cap of $10,000 on state and local income taxes, which is not adjusted for inflation, will disappear. Those who are married but file separately may deduct up to $5,000 if they itemize.

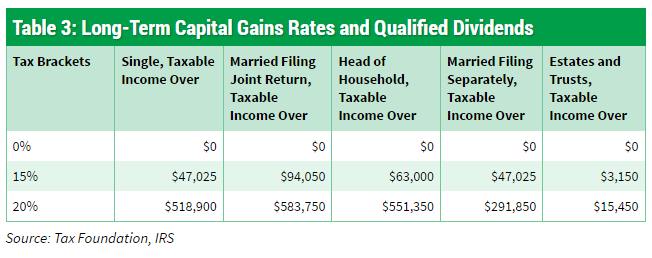

3. Favorable treatment for long-term capital gains is a cherished tax break for investors. Long-term capital gains, such as the profit on the sale of a stock held for more than one year, are taxed at a more favorable rate than short-term gains. A short-term gain is taxed as if it were ordinary income.

4. The TCJA includes a 20% deduction for pass-through businesses. Limits on the deduction begin phasing in for taxpayers with income above $191,950 and $383,900 for joint filers in 2024.

5. Other taxes you may be subject to or credits you may capture.

High-income taxpayers are subject to the net investment income tax of 3.8%, levied on the lesser of net investment income or modified adjusted gross income over $200,000 for single filers and $250,000 for married filing jointly. These amounts have never been indexed to inflation.

In general, net investment income includes but is not limited to interest, dividends, capital gains, rental and royalty income, and non-qualified annuities, according to the IRS.

Net investment income generally does not include wages, unemployment compensation, Social Security Benefits, alimony, and most self-employment income.

Congress enacted the AMT, or the alternative minimum tax, in 1969 following testimony by the Secretary of the Treasury that 155 people with adjusted gross income above $200,000 had paid no federal income tax on their 1967 tax returns.

Limits were never adjusted for inflation and, in time, threatened tens of millions with a parallel tax system.

More recently, annual patches were put into place until the TCJA was passed, dramatically increasing the thresholds for avoiding the AMT.

The AMT exemption amount for 2024 is $85,700 for singles and $133,300 for married couples filing jointly.

Exclusions for the estate, gift, and generation-skipping transfer will increase from $12,920,000 in 2023 to $13,610,000 in 2024.

Higher lifetime-exemption amounts are set to expire at the end of 2025. Unless Congress makes these changes permanent, after 2025 the exemption will revert to the $5.49 million exemption (adjusted for inflation).

The kiddie tax applies to unearned income, such as dividends or interest, for kids under the age of 19 and college students under 24.

Your child will be required to pay taxes on their unearned income in 2024, but if that amount is more than $1,300 but less than $13,000, you may be able to elect to include that income on your return rather than file a separate return for your child.

The child tax credit is $2,000 for each child that qualifies. The child must be under 17 years old at the end of the year. The refundable amount rises to $1,700 for tax year 2024, up from $1,600 in 2023.

A refundable credit means that you can take advantage of the credit above your tax liability, in this case, up to $1,700.

For the tax year 2024, you can have a modified adjusted gross income (MAGI) of up to $252,150 and may qualify for the adoption credit of $16,810 if you incur adoption-related expenses.

The amount of the credit is reduced for taxpayers with a MAGI of more than $252,150 and is eliminated when your MAGI tops $292,150.

The credit is nonrefundable, so the amount cannot exceed your tax liability. However, you may apply any excess credit amount to future years, up to five years.

IRA Contributions

The IRA contribution limit for 2024 is $7,000 for those under age 50, and $8,000 for those age 50 or older.

You can make 2024 IRA contributions until the federal tax filing deadline for income earned in 2024.

This is up from 2023’s limits of $6,500 for those under age 50, and $7,500 for those age 50 or older. You can make 2023 IRA contributions until your April 15th federal tax deadline for income earned in 2023.

SEP-IRA Limits

You can contribute up to 25% of the employee’s total compensation or a maximum of $69,000 for the 2024 tax year, whichever is less. That’s up from $66,000 in 2023. If you’re self-employed, your contributions are generally limited to 20% of your net income.

We are mindful that the tax code is quite complex. We are happy to answer any questions you may have. Feel free to consult with your tax advisor.

LPL Financial does not provide tax advice or services.