It’s Never a Straight Line

Last year was a year most investors would like to forget. While the performance was underwhelming, let’s not forget some of the lessons learned.

We recognized that a well-diversified portfolio of stocks appreciates over a long period. But we expect interruptions along the way.

Since 1909, there have only been four periods where the rolling 10-year annualized return of the S&P 500 Index has been negative.

Two occurred in the late 1930s, which coincided with the stock market collapse and the Great Depression, and two occurred in the late 2000s, which coincided with the financial crisis and the Great Recession.

Looking back 10 years prior to those periods, we arrive at the Roaring Twenties and a thriving stock market, and the stock market bubble of the late 1990s. In other words, stocks had gotten well ahead of the economic fundamentals, and an economic event forced a longer-term retrenchment.

Here is one more statistic. Over the period in question, stocks averaged a 10% annual return. Despite their volatility, stocks still outperformed savings accounts, CDs, T-bills, and bonds over the long term.

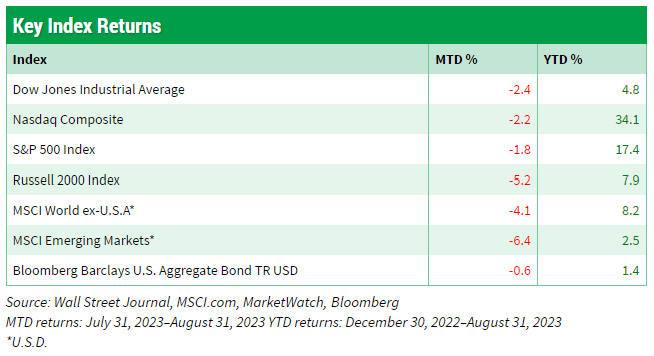

Last month, stocks took a breather. When markets are seemingly priced for perfection, any disappointment may lead to a pullback.

Last month, Treasury yields began to move higher, with the 10-year Treasury yield hitting its highest level since 2007, according to data from the St. Louis Federal Reserve.

Concerns over China’s slow recovery from draconian covid lockdowns also created some jitters.

Finally, August has historically been a weak month for stocks, per monthly S&P 500 data from the St. Louis Federal Reserve.

We’re not smart enough to time the stock market. Occasionally, we might make a lucky guess, but it’s not something we can depend on. Even the most experienced traders could get lucky once in a while, but it’s impossible to predict the highs and lows of the stock market consistently.

Few saw a bear market last year, and few expected the stock market to rally as it has done this year. In fact, many expected the economy to be in a recession by now, which would likely have created another impediment to stock market progress. We’re still waiting for that recession.

That said, control what you can control.

We can’t and you can’t control shorter-term returns. That’s out of our sphere of influence.

But there are aspects of investing that we can control.

- Long-term performance is about time in the market, not timing the market.

- Your behavior plays an important role in long-term returns. How do you react when stocks soar or falter? Does euphoria lead you to become too aggressive? Does market weakness push you to get too conservative after equities have already faltered?

- What is the best approach to your financial plan? Your mix of stocks, bonds and cash (and any other diversified asset class) plays a role. Much will depend on your appetite to take on risk.

It’s why we consistently emphasize your financial plan and your long-term goals.

The plan isn’t etched in stone. It is flexible. When life brings about changes, we can make adjustments. But we encourage adjustments in the variables you can control.

Learn More: