A Crisis of Confidence

Have you ever reflected on the foundation of the financial system? What comes to mind? Banks, investors, the stock market, the bond market, or the credit markets? That’s partially true.

They are the underpinnings, but the foundation or the bedrock of the financial system is confidence. Without confidence, we are left in a very precarious situation.

We have full confidence that when we withdraw cash from a bank account or money market fund, or for that matter, close out an account, we will have immediate access to those funds.

But bank vaults aren’t filled with cash that can be easily repatriated to depositors if, by an incredible long shot, everyone shows up one day to close their account. Our deposits are invested in high-quality bonds, Treasury bills and loans.

What happened at Silicon Valley Bank last month was simply an old-fashioned bank run. Why? Confidence quickly evaporated.

But the root cause of its demise had many regulators, investors and Fed officials scratching their heads because nearly everyone was caught off guard.

A far cry from 2008

Unlike 2008, when major banks were saddled with bad real estate loans, SVB invested heavily in a portfolio of high-quality, longer-term Treasury bonds. From a credit standpoint, these are super-safe investments. What could go wrong?

Well, nothing if the bonds were held to maturity or if interest rates had remained stable.

Bond prices and bond yields move in the opposite direction. When yields rose, the bonds fell in value, creating a paper loss.

But its customer base of venture capital investors had been drawing down on their deposits as more traditional sources of funding were drying up.

With deposits being drawn down, SVB was forced to sell $21 billion in bonds, and the bank took a nearly $2.0 billion loss. SVB’s hastily announced plan to raise capital was quickly scuttled when its stock tumbled, and depositors quickly began to withdraw cash, since a large majority of the bank’s deposits were above the FDIC limit.

Less than two days after the bank revealed its loss on the sale of Treasuries, regulators were forced to shut it down.

Time to failure: less than 48 hours from a late March 8th announcement of its plans to raise capital and a morning shuttering on March 10th.

Moreover, Signature Bank, which was heavily into the cryptocurrency space, was closed on Sunday, March 12th.

SVB and Signature were the second and third largest bank failures in U.S. history, respectively.

Regulators did not have the time to line up buyers, and the FDIC moved to guarantee all bank deposits of the two failed banks.

As controversial as it was, Treasury and Fed officials fretted over the potential of massive bank runs when markets opened on Monday.

It’s difficult to estimate the carnage we might have seen on Monday morning, but the plan to ring-fence the banks with deposit guarantees and a new lending facility from the Federal Reserve helped contain the crisis and prevent contagion.

The new lending program from the Fed enables banks with high-quality bonds to borrow against the full value (par value, not current value) of their bonds, using the bonds as collateral. In theory, there is no need to sell the bonds.

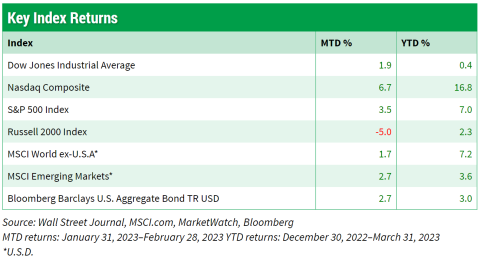

As the month came to a close, worries began to subside, and it was reflected in mostf the major market indexes.

The Fed broke something

The epicenter of 2008 was subprime lending. Today, the failure of some banks to properly manage the duration of their assets (loans and bonds) and liabilities (deposits), coupled with sharp rate hikes and regulatory missteps, are the primary causes of today’s problem.

Banks such as SVB piled into high-quality, long-term bonds, but didn’t hedge against the possibility of a rapid rise in interest rates. Rising interest rates exposed a fatal flaw in its portfolio.

Regulators will dive into the details for a more thorough understanding of what happened, but the finger-pointing has already begun.

Nonetheless, the impact may be felt for quite some time.

The Fed was probably on track to boost the fed funds rate by 50 basis points (bp, 1 bp = 0.01%) to 5.00%–5.25% at its March meeting.

Inflation remains stubbornly high, but the Fed wisely chose to defer to banking stability, and opted for a cosmetic hike of 25 bp.

It gives the appearance that inflation remains a priority, while focusing on the banking system.

It also puts the Fed in a difficult position, as it hopes to tackle two conflicting goals: fighting inflation with rate hikes, which would put added stress on banks, or concentrating on financial stability.

The crisis might do the Fed’s job for it, as tighter lending standards slow economic growth.

How much? No one knows.

Inflation hasn’t been squashed, but problems with SVB have not spread to other banks. The crisis eased as the month came to a close, and most of the assets of the failed banks were purchased.

In recent days, sentiment has shifted on rates, but sentiment is ever-shifting. How the Fed reacts this year will depend on economic performance.

As the months came to a close, fears have waned, helping shares rally, and the month ended on a favorable note.

Learn More: